LBO model tutorial with free Excel

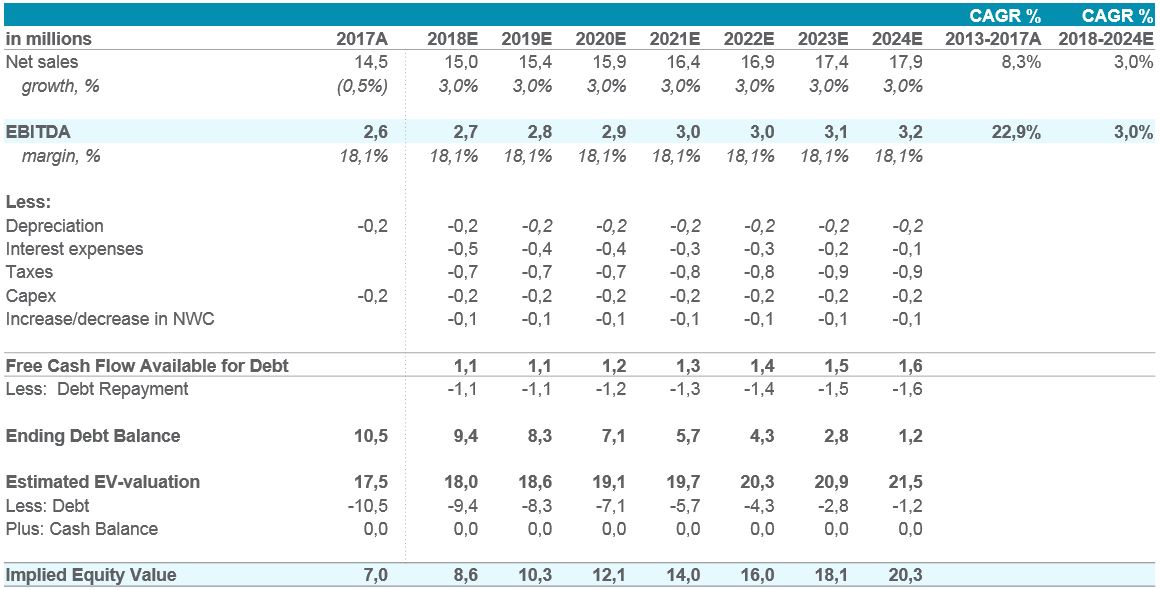

The acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of an acquisition is named a Leveraged Buyout Analysis. It is used to determine an implied valuation range for a given target in a potential LBO sale based on achieving acceptable returns.

Step by step LBO Valuation tutorial

In these coming four steps, you will be able to perform your own LBO Analysis. This LBO model is simplified in order to teach you the basics of a LBO valuation.

USE CODE: BVAL100 for 100% discount.

Expand each section to follow the (free!) LBO-model tutorial. Now lets do some modeling!

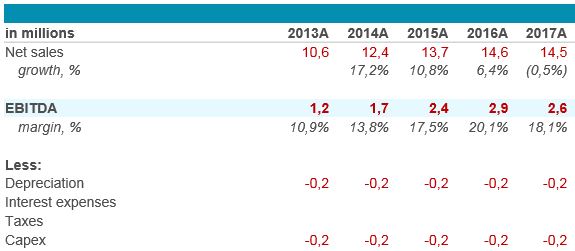

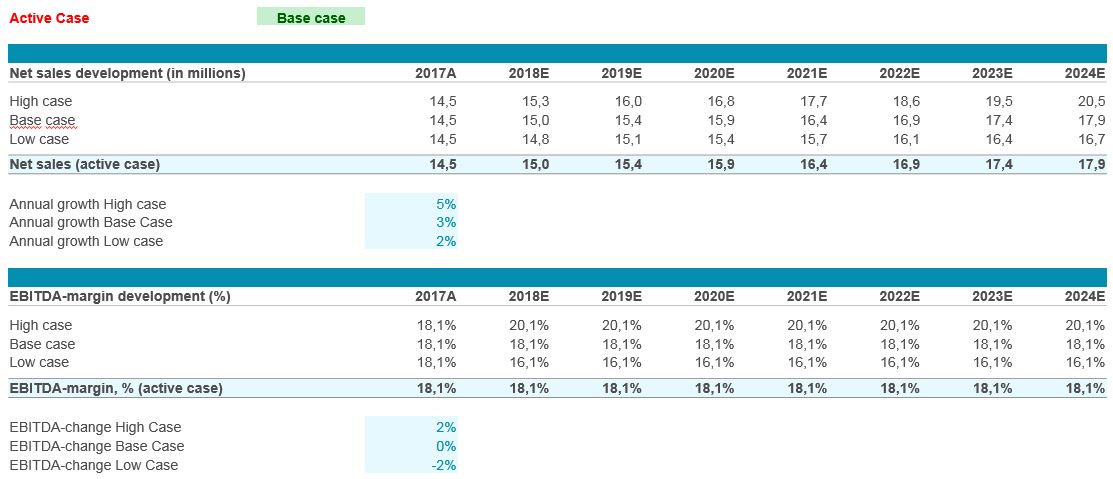

Sneak peek of the LBO model (click to enlarge screenshots)

You need to activate “iterations” in Excel for this LBO model to work properly. It can be switched on under Excel options / formulas / then check the box “Enable iterative calculations”. See picture here for help (if needed).

This will encourage me to continue to develop the best Excel models and will take very little of your time…

I will do my best to help you quick

I will do my best to help you quick

I will gladly help you with any question you might have. Either comment below the relevant content or send me an email or use my contact form which can be found here.

Specialities: Business valuations, Excel models, Business development, Investment Banking, Buyouts, Divestments, Share issues, IPOs, Management Buyouts, Leveraged Buyouts.

Have a great day! (thanks for sharing my website which helps my content available to more users)

Where do I input how much debt the company takes in in order to finance the LBO?

How do I calcuate that part?

Thank you in advance

Dear Milos, thanks for your question. You can change debt level at cell C16 “debt level”. If you wish not to use a multiple, then enter debt into cell C11. Good luck!

Very helpful,

thanks a lot.

Thank you very much for this comprehensively-explained LBO Model. However, this model assumes the target has no existing debt. Do you have such LBO models with existing debt of target? Many Many Thanks

Shunmas, you must then assume you refinance the target when it is acquired. The proceeds you pay is to the former owner who can repay existing debt with the proceeds from the transaction.

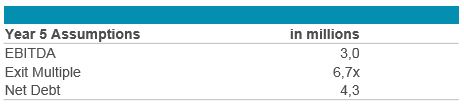

Step 4 – Understanding the Results section has a typo. It says the IRR is 17%, but really it is 19% (as the picture above the comment, and the model itself, both correctly reflect).

Nick,

Thanks =)

CAN I GET AN LBO MODEL AND PROCEDURE

JACQUES,

A complete LBO model with tutorial is already provided on this website, https://www.business-valuation.net/methods/lbo-analysis/