Determining business value

Determining business value – value of a business

The principals of the valuation methods we use in the simple and advanced models are briefly described under methods. Below we will try to describe how we do to determine the value of your business based upon these methods.

Overview

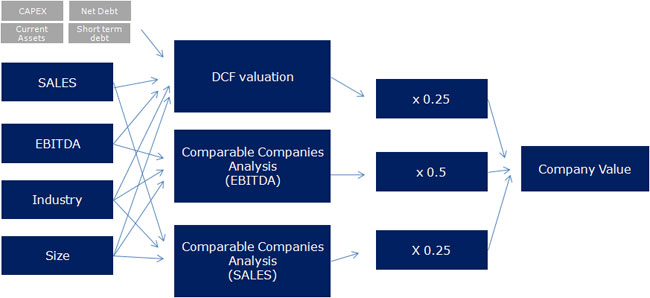

Below is an overview of factors that determine the value of your business in our models. In the advanced version, CAPEX, net debt, current assets and short term debt are also inputs which affects the DCF valuation.

Database Inputs

We have collected data from over 3,000 companies worldwide (since this is a world wide service) from a database called Reuters Knowledge. From these 3,000 companies we have collected five observations each; EBITDA LTM, EBITDA FY1, SALES LTM, SALES FY1 and Beta. We have then organised all companies into different industry groups and calculated a median value for each key ratio. These key ratios will be multiplied with your inputs, with an adjustment of company size which is a factor that we have determined in order to reflect the difference of required rate of return of small and large businesses.

Your Inputs

We cannot control nor do we track your inputs, so make sure the inputs you make are correct. When determining future growth, do not grow your business (in the model) with 100% every year, since it is not very likely that you will achieve that (called a hockey stick). Try to make your assumptions rather a little too low than too high.

Calculations

Our models are based on formulas consisting of over 100 calculations and combines your inputs with the database research that we have collected. Altogether it sums up to a value of your business. We have chosen to base our models on earnings, and that is why we have given it a 50% impact in the valuation model and the cash flow valuation 25% as well as the analysis based on sales.

The Value of your Business

What our models calculate is the market cap of your business/ we value your business and we do not consider your net debt. If someone would buy your company, they would probably just pay for your business/ buy your outstanding shares. Depending on how the deal is performed they could also buy your net debt – that would in fact be the enterprise value of your company. If you have a lot of cash and assets such as real estates and so on, they could also pay for that, but that is the enterprise value.

Market Cap – Net Debt = Enterprise Value (if you have more cash than debt, net debt becomes negative)

If you get the target value 100 in our model and you have a net debt of -20 (you have more cash than debt) = your enterprise value is 120 and that is what someone would have to pay you if they bought everything. It is however common that this money is paid to you as dividend before the new owner acquires the business. If you have more debt than cash, your enterprise value would be lower than the market cap and the new owner could either let you pay off this debt or acquire the debt.